Portfolio

With 12 years of experience, I’ve navigated diverse challenges — applying best practices that place people at the center.

Increasing Customer Retention at the Dealership

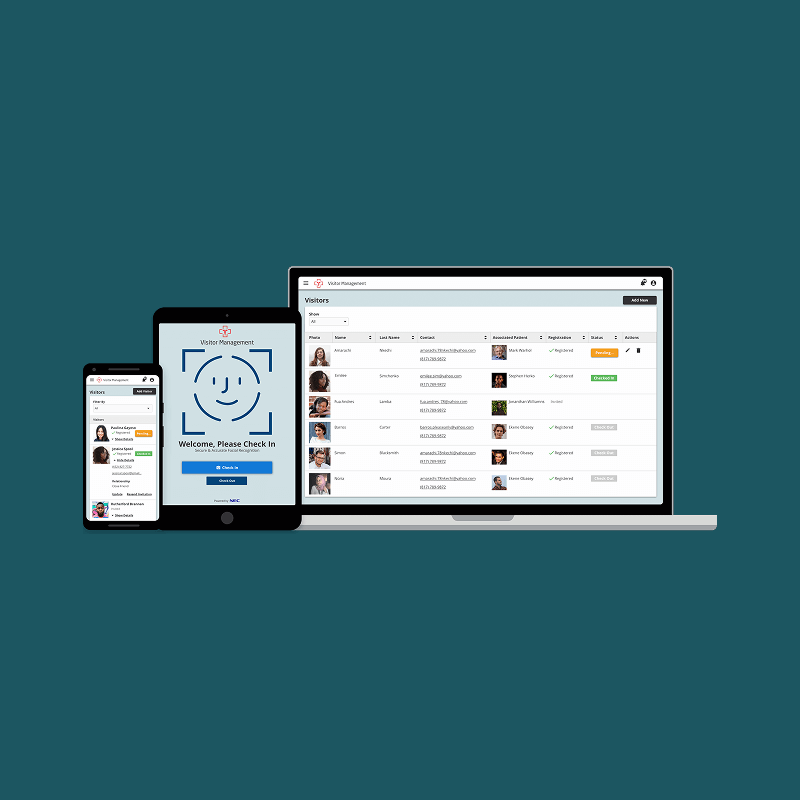

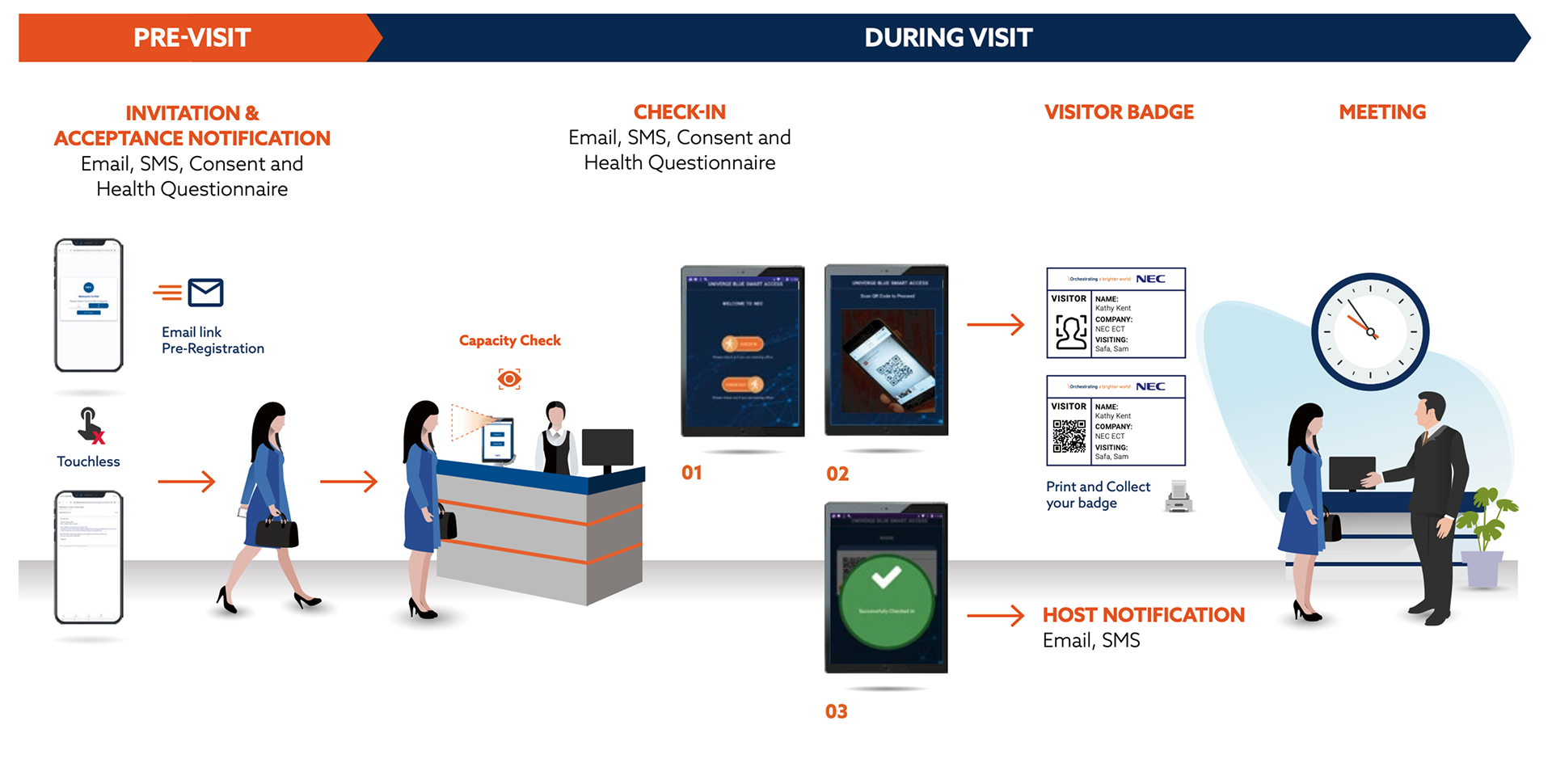

The client, local dealership, sought to increase customer service retention by increasing sales of Planned Preventive Maintenance (PPM) plans*. The goal was to demonstrate how NEC’s Visitor Recognition white label product would achieve the business objective.

*PPM Plans: Cover a predefined period of scheduled vehicle maintenance—such as oil changes and tire rotations—based on the guidelines in the vehicle's owner’s manual. Leading to customer retention as well as upselling.

My Role

As the UX Designer, on Business Incubation team at NEC, guided the team and client through a Design Thinking discovery engagement that included interviews, feedback synthesis, and artifact production.

Team:

> Client Success Manager

> Product Manager

> Solution Architect

> UX Designer

Value Unlocked:

> Boosted Customer Service Retention

> 24%↑ PPM Plan Sales

> ↑ Satisfaction in PPM savings.

Process Overview

> 1:1 Interviews

> Problem Definition

> Solution Ideation Workshop

> New Process Blueprint

> Solution Piloted

Type:

B2B Service Design

Timeline:

6 months

The Challenge

Identify innovative opportunities to increase customer service retention, at the dealership, through PPM plan sign up by leveraging NEC's facial recognition visitor management solution.

Research - User Interviews

In collaboration with the Success Manager, we were able to setup and conduct on-site employee and customer interviews.

Onsite Customer Interviews

Customers perceived dealership PPM plans as costly and with long service wait times and prefer fast, affordable, and professional services.

Customer Needs:

Avoid paying higher dealership costs.

Minimize the time spent getting vehicle serviced.

Maintain their vehicle in optimal condition.

Protect the value of their purchase

F&I Rep Interviews

PPM plans present cost-savings for customers. Typically, they are purchased during or after the F&I phase of the vehicle purchase process.

PPM Plan Benefits:

-

Fixed Costs: Protects from inflationary prices.

-

Fast Service: When scheduled ahead of time.

-

Value Protection: Serviced by OEM-Cert. Service Technicians, extending the vehicle lifespan and resale value.

How might we help customers see PPM plans as the obvious choice to meet their needs?

The interviews revealed that customer’s perception on PPM plans overshadowed the true benefits. Therefore our problem statement focused on creating an experience that changed the customer perspective on PPM plans.

Solution Ideation – Client & Team Workshop

Together with my product team and an SME (F&I Sales Rep), we flushed out ideas that answer the problem statement.

The ideas centered around ways to present convincing content that compared the cost-savings of a PPM plan against the rising costs of going to non-OEM certified vehicle repair shops over time risking the vehicle value.

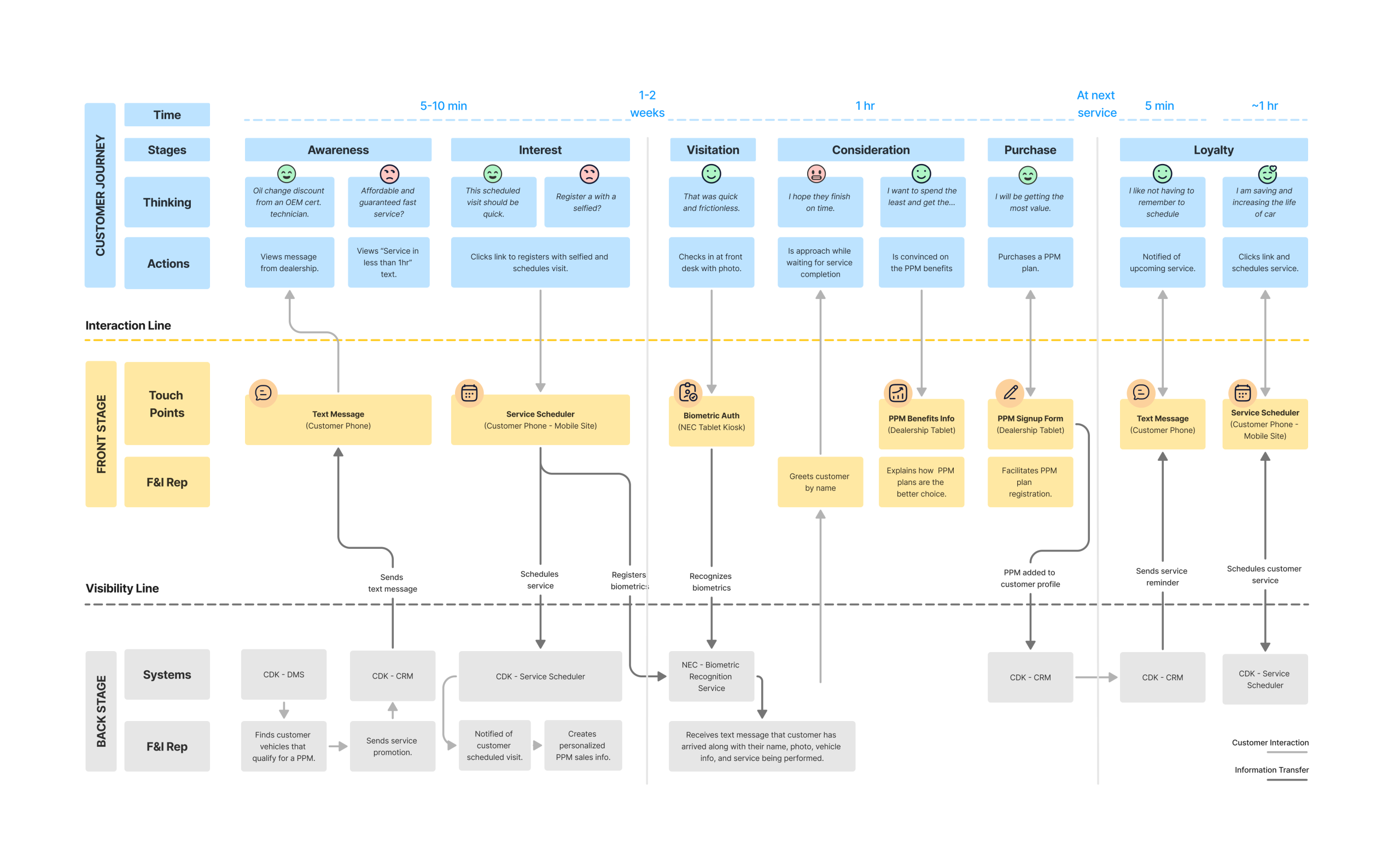

Process Blueprinting - The New Experience Inner Workings

We presented a visualization of the end-to-end experience, with a Process Blueprint that demonstrated how the customer experience is supported by touch-points, back-end services, and the F&I sales reps. This helped the client see how the solution fits and enhances the customer journey.

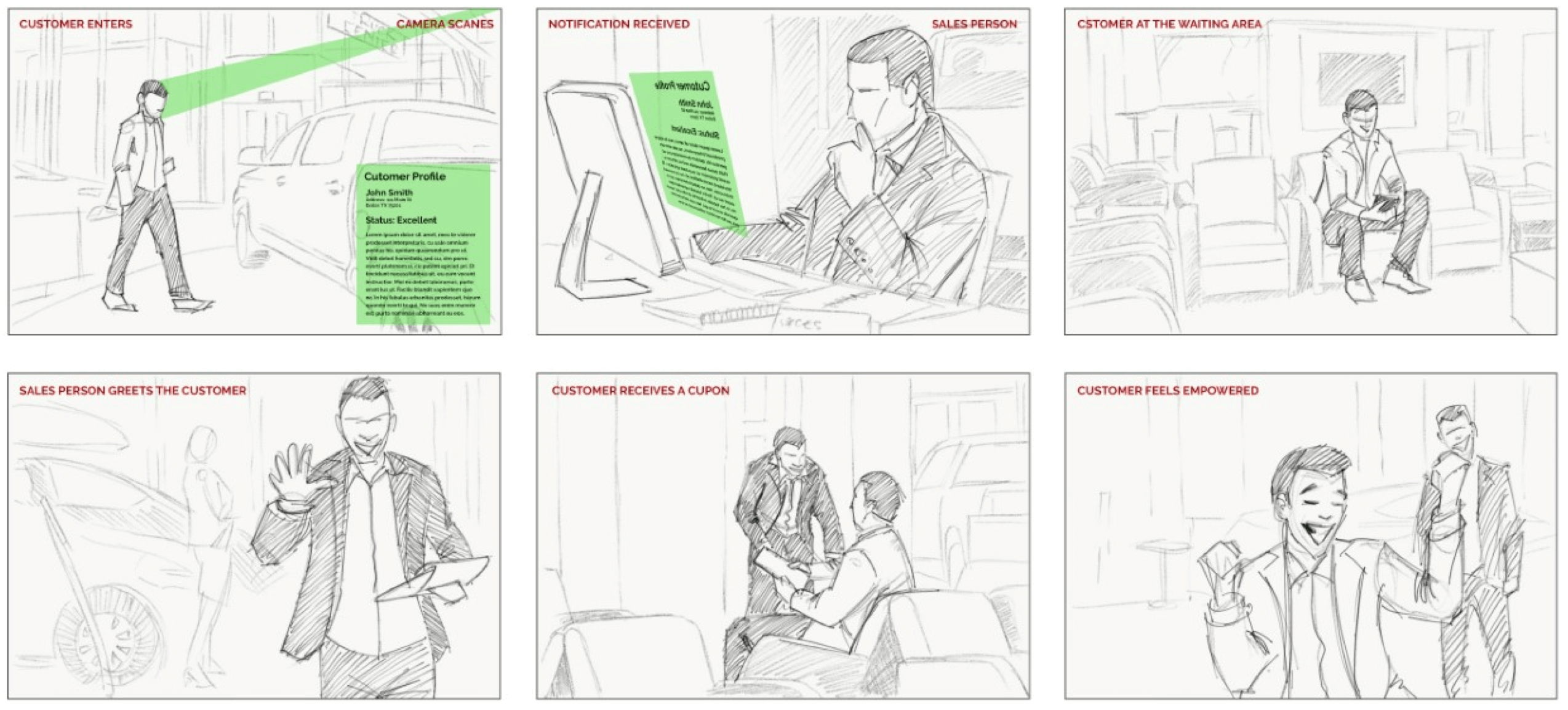

Storyboarding

With the assistant of a media artist, we rendered a storyboard, visualizing the new customer service experience.

The customer pre-registers for a discounted service appointment. F&I Rep builds custom PPM plan. Upon arrival, he is greeted by name and explained the benefits of PPMs. He excitingly signs up knowing he is saving money while protecting his investment.

We received the green-light to run pilot and validate the new customer service experience.

During the pilot, the monthly PPM plan sale increased as a direct result of the new customer service experience, enabling F&I reps to engage customers with personalized information demonstrating the long-term cost-savings of PPM plans.

Next Steps

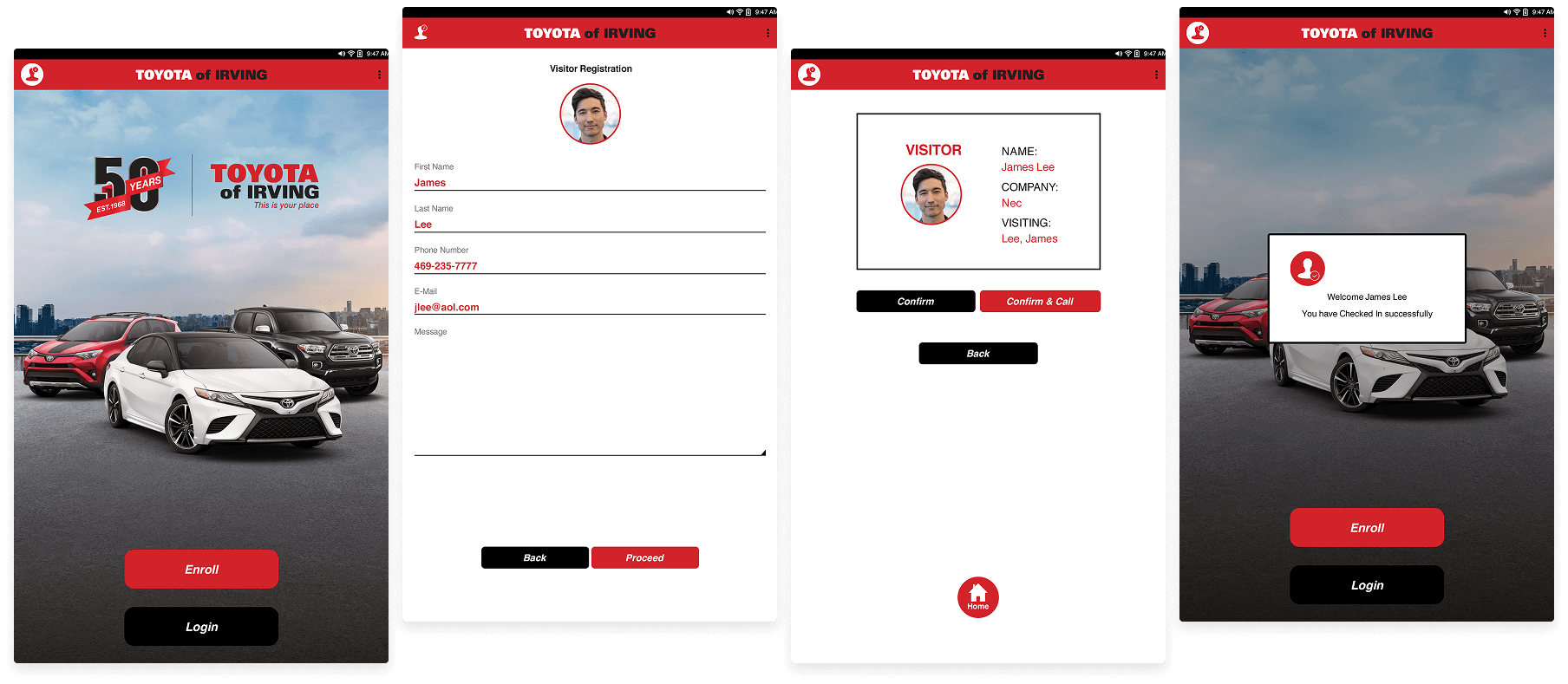

Modify NEC’s white label facial recognition visitor solution with the dealership’s branding.

What went wrong?

Privacy Concerns

We leaned heavily on the Visitor Recognition tech (biometrics) without fully addressing customer privacy concerns or mental models. Not every customer opt-ed in to use the solution due privacy concerns.

The research did not include customer sentiment on using facial recognition, leading to low-adoption.

Employee Buy-in

Only one employee role (F&I Sales Rep) was included in the workshop, leaving most feeling like the new process was imposed without seeing clear benefits to them (e.g., extra training for no commission boost).

UX research should have included deeper empathy work with employees to align incentives and reduce friction in their workflow.

Key Takeaways

Misalign Mental Models

–

Customers reject products not only because of the product’s flaws, but due to misaligned mental models (e.g., “dealerships are expensive, why does the dealership need my face?”).

Benefit Framing

–

Benefit framing, PPMs can be presented as “cost-saving shields” (vs. “upsells”) when compared to using local repair shops over time with data visualization.