Portfolio

With 12 years of experience, I’ve navigated diverse challenges — applying best practices that place people at the center.

Empowering Dealers to Thrive in a Changing Market

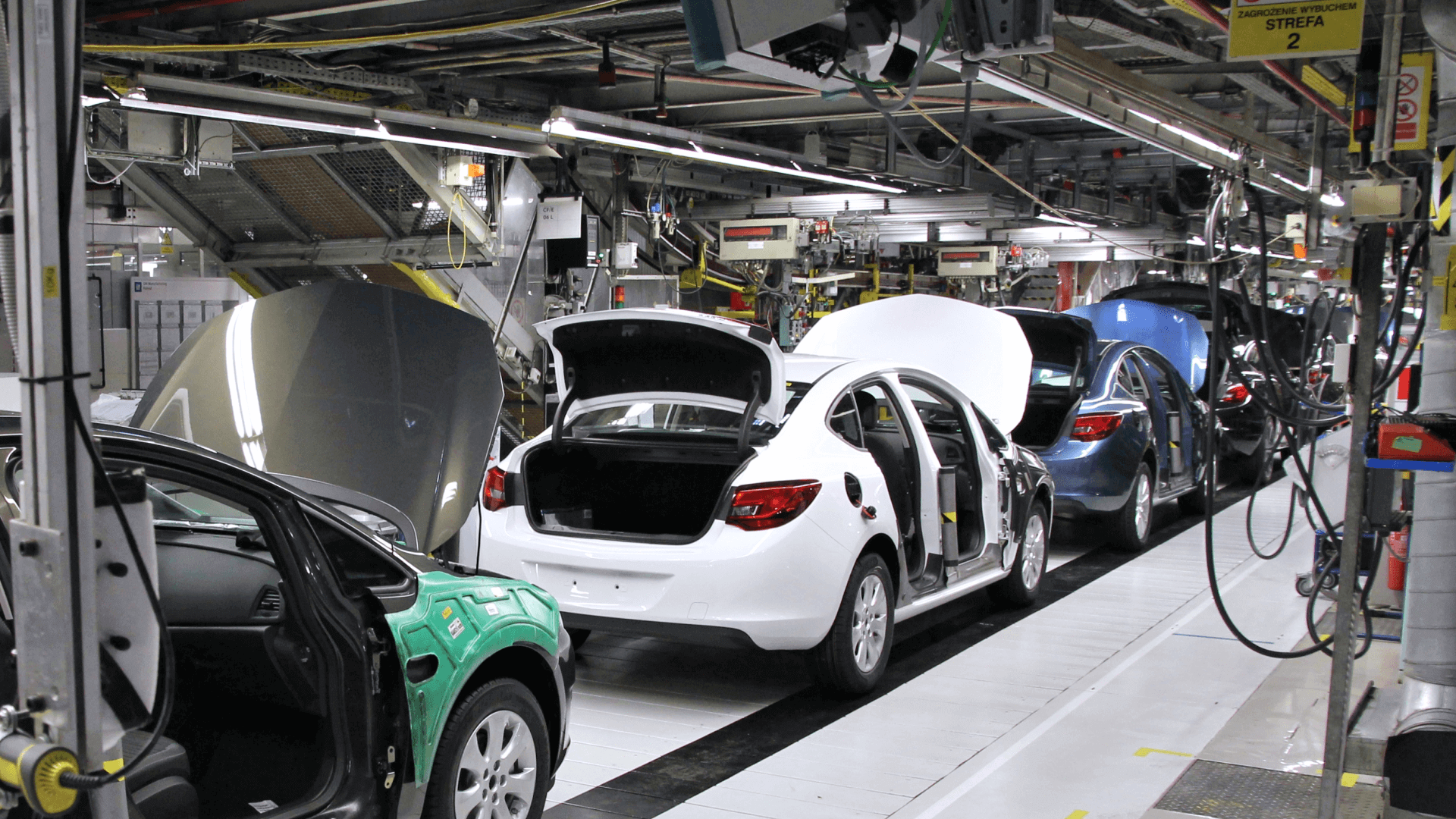

When automakers like Ford, Honda, or Chevy builds a vehicle, the NHTSA (National Highway Traffic Safety Administration) assigns a unique VIN, which becomes the key identifier in all digital records. Dealers rely on Cox Automotive’s Vehicle Inventory Platform (CVIP)—the system behind tools like vAuto, AutoTrader, and Dealer.com—to manage, market, and sell their inventory. Every vehicle record contains 500+ data points, all tied to that VIN.

But when supply chain disruptions hit and inventory dries up, dealers suffer. To keep sales flowing, OEMs provide pre-VIN records—digital placeholders for future vehicles that haven’t been built yet.

The Problem? CVIP can’t properly handle pre-VIN records. Since the system depends on VINs (consistent unique identifiers), dealers are forced to use manual workarounds or external tools, creating inefficiencies and lost sales opportunities.

The Solution? Upgrade CVIP to support pre-VIN vehicles. Easy right? However extensive discovery would be needed to determine the solution and with so many competing tech priorities, leadership asks: Why invest in this? How does the lack of pre-VIN support impact dealers business? What is the effort

Create a compelling narrative for pre-VIN support by demonstrating the impact on dealer customers in order to secure investment in enhancing the enterprise vehicle inventory platform.

Process Overview

> Researched the problem

> Co-extracted insights

> Visualized the pain points

> Framed the problem

> Form the solution narrative

The Team

> Product Directory

> Platform Architect

> UX Architect

Type

> B2B UX Strategy

Timeline

> 9 Months

My Role

Lead UX Architect

Being the UX Architect for the platform product team, I lead the problem discovery research to demonstrate how the lack of pre-VIN support in CVIP impacted our dealer customers.

Results

✓ Secured Platform Investment

Through research based storytelling, leadership approved additional funding for PreVIN support, representing a $1.2 million opportunity in yearly revenue.

Researching the Problem

I conducted research and interviews with those closest to the problem, dealer customers, and those who where the key to the solution platform leadership and architects. Then, through collaborative sessions with the team and using an Affinity Clustering method, we drew insights from the information collected in the research.

Interview Highlights

5 Dealer Interviews

Inventory Managers overseeing all aspects of vehicle inventory; acquiring inventory, ensuring optimal stock levels, and maximizing dealership profitability.

Objective:

Capture the pain points caused by the lack of pre-VIN support in CVIP.

Insights:

- Pre-VINs Maintain Cash Flow

Slow issue resolution delays sales and frustrates dealers. - Impact to Sales and CSAT

Inconsistent data across platforms confuses customers and hurts trust. - Key Workflows are Broken

Dealers are unable add preVINs to their dealer solutions, creating manual error-prone workarounds.

4 Stakeholder Interviews

Composed of Sr. Directors and Principal Architects, these where minds behind the curtain who knew exactly why CVIP couldn’t handle pre-VIN records today.

Objective:

Understand the barriers and effort for supporting pre-VIN

Insights:

- Failed VIN-Decoding

CVIP relies on VIN decoding to extract NHTSA specs and build complete vehicle records. Without it, dealer tools face unpredictable impacts, requiring deep technical investigation. - Failed pre-VIN to VIN Update

Pre-VIN records need a consistent unique ID to link to final VINs. Without this, CVIP can’t distinguish new records from updates.

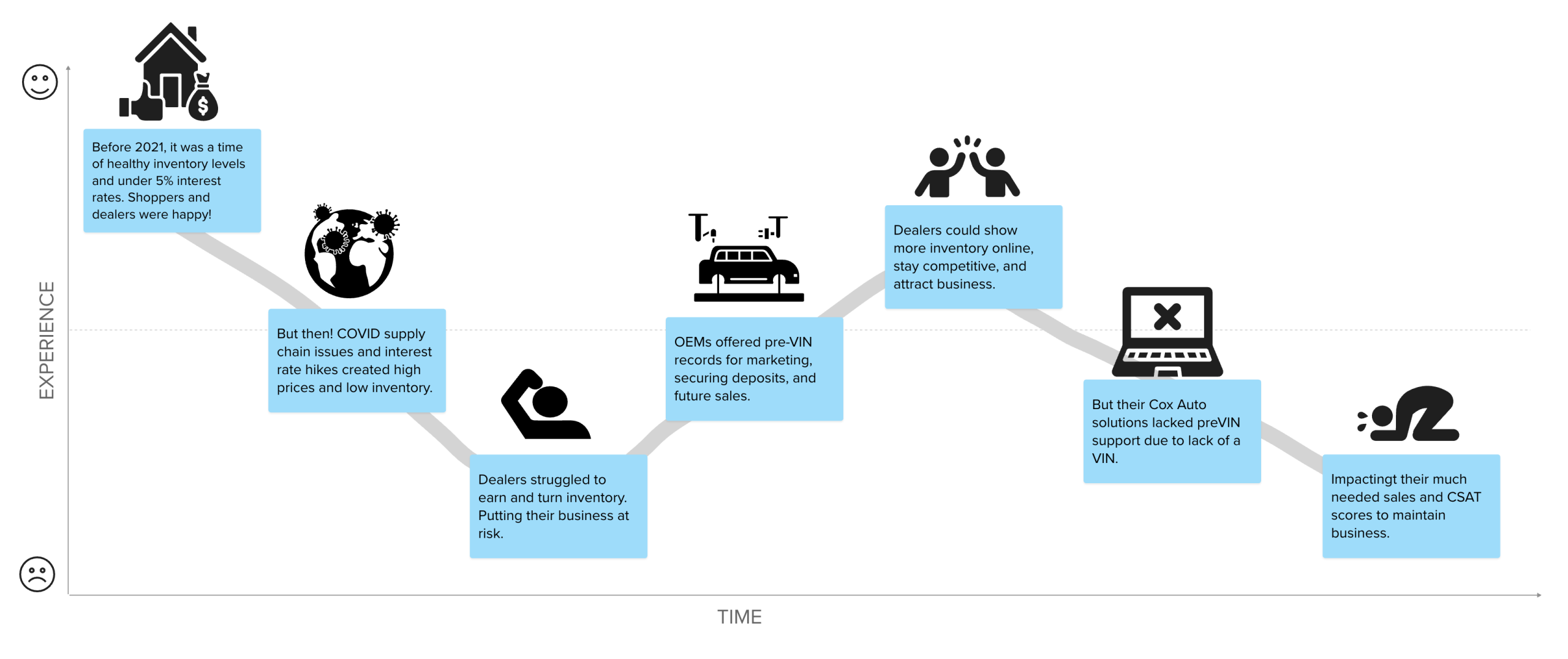

1 Insights Advisory Interview

I reached out to our Enterprise Insights and Advisory Director, who explained the problem from a high-level. It was not just the lack of pre-VIN support causing pain for dealers but the market conditions.

Objective:

Streamlined export setup processes and minimal troubleshooting time.

Insights:

- Supply Chain Grid-lock

A perfect storm of disruptions—COVID supply chain chaos, war in Ukraine, and semiconductor shortages—has crippled auto production from parts to assembly to delivery. - Economic Conditions

Skyrocketing interest rates and critically low inventory are driving prices to painful new highs, impacting sales.

Without PreVIN: Broken Data Flow

The technical pre-VIN problem was two fold: without decoding the record is incomplete thus impacting dealer solutions and with no consistent unique identifier, updating a pre-VIN to a valid VIN was impossible.

1. OEM sends pre-VIN record to the inventory platform

❌

2. Inventory platform fails to VIN decode (no VIN)

❌

3. Dealer solutions fail display VIN decoded data

4. OEM build vehicle and sends valid VIN

❌

5. CVIP fails to update the pre-VIN to VIN

VIN Decoding:

Extracts the official specs of the vehicle that the OEM submits to NHTSA. It is a form of independent verification to protect consumers from misinformation.

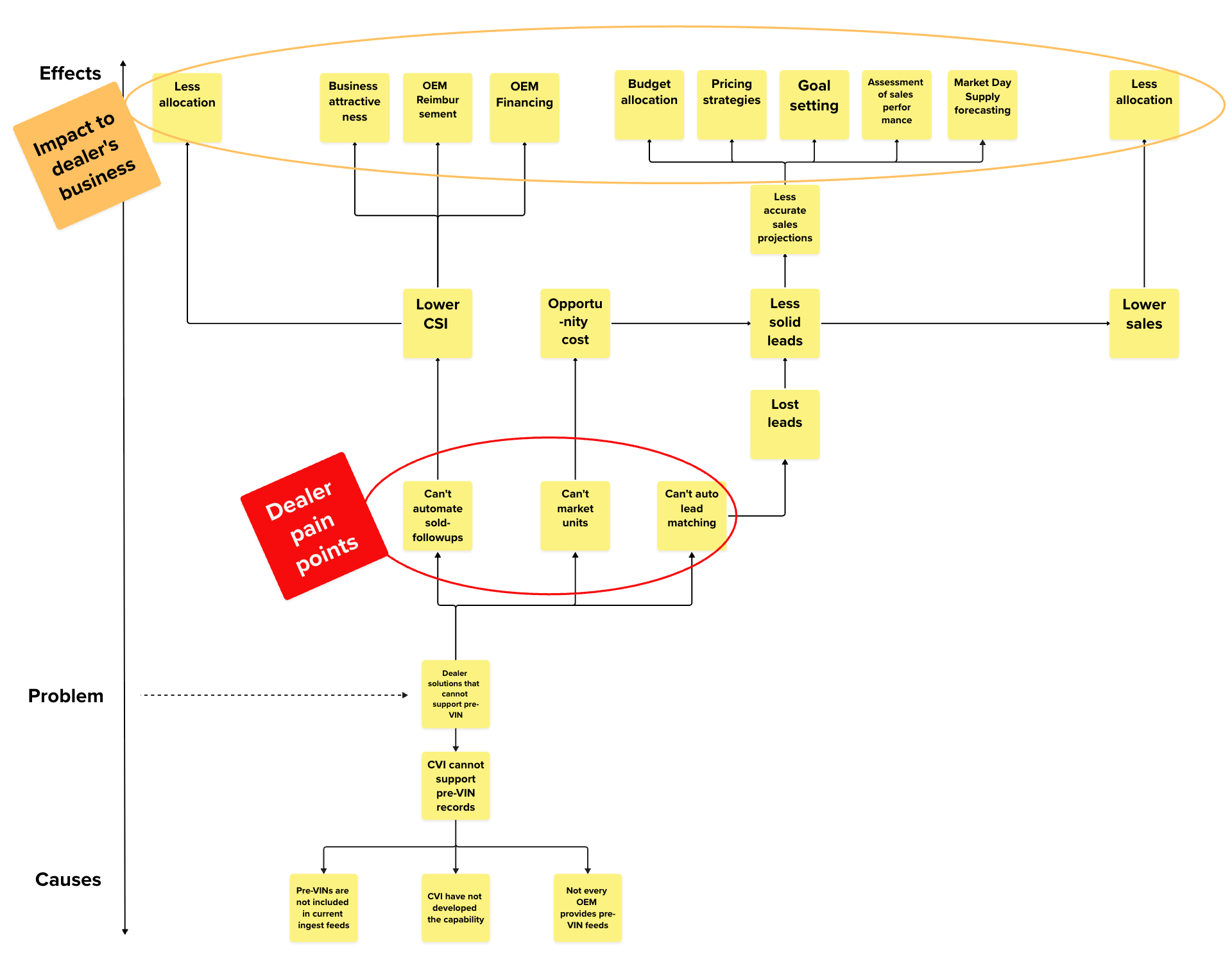

Digging Deeper with Tree Analysis

Problem tree analysis uncovered three root causes of low sales and CSAT. Since OEMs prioritize high-performing dealers, this creates a vicious cycle: poor performance → fewer allocations → worse performance.

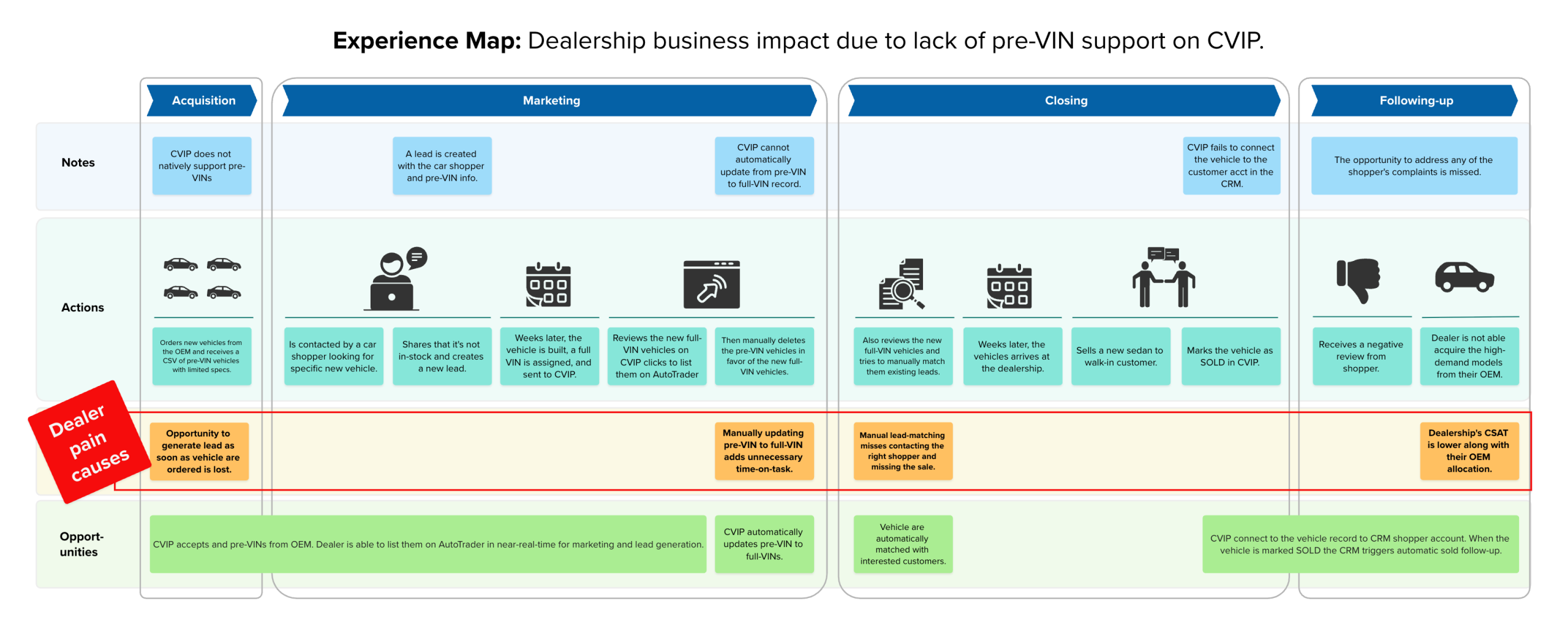

Without PreVIN: Dealer Pain Points

Placing context around the dealer pain points was instrumental in demonstrating the impact to their business in the typical vehicle acquisition to sales lifecycle.

Without PreVIN: Broken Workflows

The technical pre-VIN problem was two fold: without decoding the record is incomplete thus impacting dealer solutions and with no consistent unique identifier, updating a pre-VIN to a valid VIN was impossible. Here’s a high-level data flow explanation.

❌

Lost Marketing Time

Between ordering and receiving vehicles, dealers lost the opportunity to market and generate leads that secure deposits.

❌

Manual Lead-Matching

When a customer places a lead on a vehicle yet to be built (pre-VIN), the system cannot match it to the valid VIN when it becomes available, requiring the dealer to do it manually.

❌

Missed Sold Follow-Ups

Without a unique identifier connecting pre-VIN to the valid VIN, the dealer’s CRM does not trigger sold-follow ups to ensure the customer is happy with their purchase.

How might we help dealer customers avoid losing OEM vehicle allocations due to reduced sales and CSAT caused by the inability to automate lead matching, sold follow-ups, and maximize marketing time?

Influencing Through Storytelling

We presented the research findings with supporting artifacts. Then, I brought it to life by telling the story of how market forces brought the demand for pre-VIN to our doorstep, creating pain for dealers. More importantly, preVIN support is a must-have safety feature that provides essential support for dealer customers when unpredictable market forces impact inventory.

With PreVIN: Working Data Flow

Pre-VIN support would require OEMs to provide a persistent unique identifier for record updates and the VIN decoding dependency to be mitigated.

1. OEM sends pre-VIN record to the inventory platform

✓

2. Inventory platform omits VIN decoding (no VIN)

✓

3. Dealer solutions handle lack of VIN decoded data

4. OEM build vehicle and sends valid VIN

✓

5. CVIP to updates the pre-VIN to VIN

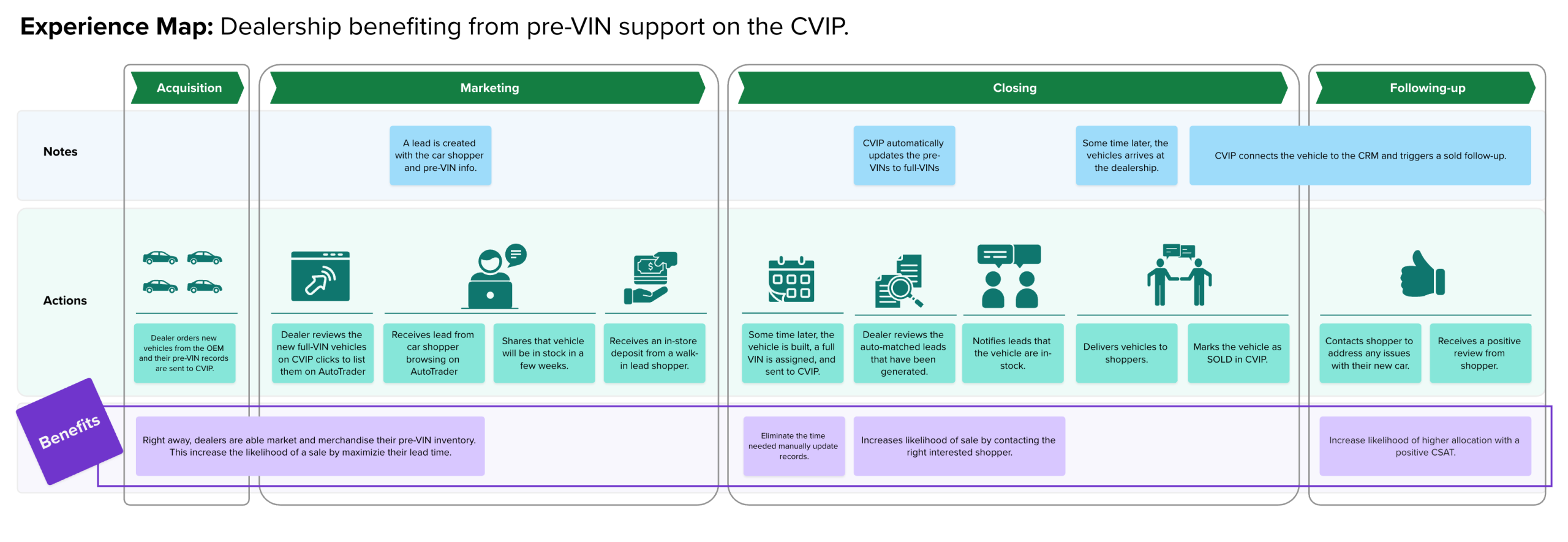

With PreVIN: Dealer Benefits

The experience map demonstrates how investing in pre-VIN support would turn dealer pain points into benefits.

With PreVIN: Working Workflows

With preVIN support in Cox Auto dealer solutions, dealers can attain benefits thanks to working workflows that maximize business during times of low inventory.

✓

Maximized Marketing Time

Right away, dealers are able market and merchandise their pre-VIN inventory. This increases the likelihood of a sale by maximizing their lead time.

✓

Automatic Lead Matching

Leads for pre-VIN vehicles are matched automatically to valid VIN vehicles, thanks to a unique identifier.

✓

On Time Sold-Follow Ups

Decreasing the likelihood of receiving negative CSAT that impacts inventory allocations and thus inventory volume.

The Outcome:

✓ Platform Investment Secured

Next Steps: UX, product, and engineering collaborated to implement pre-VIN support, improving automation, lead matching, and marketing—helping dealers protect allocations and sales.

What went wrong?

Dealer Interview Participation

I sent 20+ interview requests—zero responses. So, I tapped a senior researcher and a dealer performance manager to help with recruiting.

- We embedded a quick, eye-catching banner message inside the dealer tools they use daily. The pitch was simple: Answer a few questions, hop on a quick call, get a Starbucks gift card (because who says no to free coffee?). Finally, some traction

Siloed Research

Conducting dealer interviews independently streamlined discovery but created a disconnect with product and engineering.

- I provided interview recordings and transcripts for review prior to the Affinity Clustering exercise, to arrive at the same conclusions.

Research Scrutiny

The qualitative findings lacked quantitative data showing the prevalence of each issue.

- We reframed the discussion around the urgent need for platform stability to adapt to rapidly shifting market demands.

- Even a single negative experience from a dealer within a major dealership group could trigger widespread repercussions—making scalability and reliability critical.

Key Takeaways

Collaboration is Critical

–

Collaboration during discovery to arrive at the same conclusions ensured a holistic understanding of the problem, reducing siloed decision-making.

Visualizing Pain Points

–

Using affinity mapping, problem trees, and experience maps helped stakeholders grasp the issue quickly and align on priorities.

Stories Drive Impact

–

Presenting findings as a narrative made the problem relatable, ensuring stakeholder buy-in for the solution.